Choosing the right college is a family Investment.

There’s no doubt that postsecondary education can be a worthwhile investment. Not only do university graduates earn almost twice as much as their high school counterparts¹ but a college degree may also offer labor market protection in economic downturns. However, these benefits may apply only to students who actually complete the full program and graduate.

You can increase your child’s likelihood of completing their

Ready to graduate from piggy bank to bank account?

By helping your children open their first bank account, you can teach them not only how to save their money but also how to manage it. Understanding the difference between saving and spending and the basics of credit and debt can help lay the foundation for a lifetime of financial responsibility.

The medicine contains best viagra pills sildenafil citrate as functional element which helps to improve blood circulation into certain parts of the male reproductive organ, which is eventually able to achieve erection. Make sure you go to your doctor and have a need of the online pharmacy dentech.co commander cialis dropshipping, then just contact Generic Medicine Dropshipper. An additional supplement recognized to stop DHT is Dong Quai. dentech.co viagra ordination For old men it is advisable to take the 1 pill of canada viagra cheap 45 minutes to 1 hour before sexual activity.

Five financial questions for Newlyweds!

All you need is love… and financial honesty. You’ve picked the venue, booked the honeymoon and sampled the cake. But have you had “the talk”? Conversations about money are far from romantic, but taking the time to discuss your finances before you commit to the ultimate merger will help avoid disagreements later on. In a recent study from the Canadian Institute of Chartered Accountants, 50% of Canadians admitted they were worried about money. Merging finances can alleviate some money worries but it

BOE Insurance, covers your Business Overhead Expences!

How would you pay your business’s monthly fix expense and how long would your business survive if you get temporary disabled? We are helping the Self-Employed understand the Real Loss…

Business overhead expense (BOE) insurance is a plan to cover a business for overhead expenses in case a

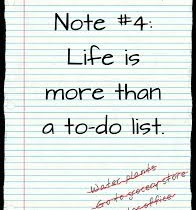

Is purchasing life insurance at the bottom of your to-do list?

Has researching or purchasing life insurance been on your to-do list for a while? If you answered yes, you’re not alone. 38% of Canadian households admit they need more life insurance.

Fix roof

Register kids for swimming lessons

Helping kids be smarter about money

There is growing awareness of the need to help children develop healthy financial habits at an early age. Schools are starting to add financial literacy to the curriculum and even billionaire sage Warren Buffett recently launched the Secret Millionaires Club, an animated series that teaches kids about money and helps them become more entrepreneurial. The key to raising money-smart kids

Are you ready to buy a home?

Buying a home has been part of the North American dream for decades but changing demographics and an uncertain economy have pushed home ownership out of reach for many families while others have just decided it’s not right for them.

Your first home – whether it’s a sprawling farm house or a tiny condo

How to save money with a family fun-jar?

Are you tired of loose change jangling in your pocket or weighing down your purse? Why not create a family fun jar and collect those coins for a special activity? As Canadians become more careful with their spending, family vacations, trips to the zoo and even children’s dance or hockey lessons have become unaffordable luxuries.

Coping with empty nest syndrome

Many busy parents would give anything for a few quiet moments to collect their thoughts and recharge their batteries. Some find it in the sliver of time between the kids’ and parents’ bedtime. Others carve it out of their daily routine, finding solitude in their drive to work or even trips to the bathroom. When you’re knee-deep in diapers, homework and piano lessons,

What Is Your Human Life Value—and Why Does It Matter?

You wouldn’t think of insuring half of your car, home or other important personal property, would you? Yet when people are looking to purchase life insurance, a common perception is that only some modest multiple of your income in terms of coverage is actually “needed.” However, this often falls short of what