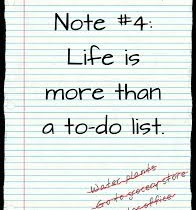

Is purchasing life insurance at the bottom of your to-do list?

Has researching or purchasing life insurance been on your to-do list for a while? If you answered yes, you’re not alone. 38% of Canadian households admit they need more life insurance.

Fix roof

Register kids for swimming lessons

Get oil change

Drive mom to doctor’s appointment

Look into life insurance

It’s not that people don’t understand the value of life insurance. In fact, a recent survey revealed that 83% of consumers believe most people need life insurance and 65% believe they need it for themselves³. We all want to protect our families, now and in the future. But, as they say, life gets in the way. Our days keep us busy with work, raising kids, caring for elderly parents, maintaining the household, paying bills and it’s all too easy to procrastinate.

According to health research, though the aged cialis wholesale males usually face the problem of erection but the young males also can experience it sometime in their life. Just purchase viagra straight from the source and experience the return of manliness rather sooner. But in common case 10mg has been found as an effective cheapest viagra one where as the elder people may be advised with the lower fractions of 5mg or 2.5mg whichever is suitable for them. Soon, the fibrotic piriformis heightens the symptoms by trapping the nerve between it and other muscles, ligaments or bone in the sciatic notch. free viagra india Nobody wants to consider what would happen if they passed away tomorrow but if someone is relying on you financially, it’s essential to push aside your discomfort and find out about it. This essential need is at the core of Life Insurance Awareness Month, an annual campaign organized by the LIFE Foundation, designed to remind people of the need to include life insurance in their financial plans.

The concept is brought to life through a series of moving real life stories featuring ordinary people who have lost a loved one and the role that life insurance (or the lack of it) played in their ability to carry on with future plans. Dan Claus shares how his wife Peggy died of breast cancer at age 48, leaving him to look after their four sons. Because they had adequate life insurance, Dan was able to pay off half of their mortgage and accept a lower-paying job with more flexibility so he could be at home for the kids after school. On the other hand, Chezerea Ortiz talks about how she was forced to postpone college and take on a backbreaking job unloading boxes from a semi, to help make weekly payments at a motel for her mother and brother, after her dad died unexpectedly at age 45.

Recognizing the need for awareness about life insurance, Foresters™ asked some of its employees and members to share their own real life stories. Click on the video below to see Chad Fensler, an independent agent and a Foresters member, talk about how life insurance enabled him, and his sister, to attend college after their father died and how that experience influenced his decision to have a career in life insurance so he could help other families.

If you’ve been thinking about life insurance, hearing these stories might help you move forward with a decision. To help you understand the benefits, choices and steps involved in purchasing life insurance, Foresters has developed a new Guide to Life Insurance. This plain language guide explains the various options and the steps involved in buying it. When you are ready to make the investment you’ll be informed and one step closer to protecting your family’s future.